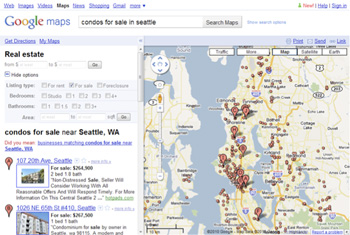

Ok, Google fans, no need to panic, you can still search for everything though your favorite search engine. You can no longer search for real estate listings, however, on its Maps portal. Everyone can continue to find real estate websites and related content via Google. Maybe that's even how you found this blog!

Discontinued

Actually, interested parties can still find real estate listings on Google Maps - until February 10, 2011. After that date, everyone has to revert to their previous method of searching for property. Yet Google does not expect potential home buyers to be too upset with the loss of this service.

Despite the search engine's tremendous popularity, few people were using the real estate feature. Now the news about low usage might seem odd to many observers. After all, Google holds a dominant market position. Yet in their recent statement, the corporation acknowledged the reason behind the lack of response to real estate listings on Maps.

"We recognise that there might be better, more effective ways to help people find local real estate information than the current feature makes possible. We'll continue to explore this area, but in the meantime, Google offers other options to home-seekers." ~ Google Inc.

Tough Competition

As well, Google's response noted "the proliferation of excellent property search tools on real estate websites." There is much truth in that statement – at least real estate statistics point in that direction. A 2009 National Association of Realtors survey showed that 90% of modern home buyers use the internet in their property search. Buyers sift through photos and take virtual tours of properties in their preferred location and price range. Consumers make short lists for viewing based on their online observations.

Although Google is a force to be reckoned with, this corporation has competition. Yet in this instance, the presence is not Yahoo or another search engine. Google is forced to compete with quality real estate websites.

Indeed, it makes sense that real estate websites can challenge Google in this area. Expert realtors and industry leaders know real estate. There is truth in saying - knowledge is power.

Of course, Google executives are not shocked by this recent development. They knew the score going into the game. As well, officials in the real estate industry expected this result. Former REA chief executive Simon Baker mentioned the probability of failure in recent days as well as at the time of the original announcement about the venture.

"The issue is that it's hard, but not necessarily impossible, but the thing is you need to have a coordinated and thought-out approach. I think they had something partially thought out, but there were elements they didn't understand," says Simon Baker, former REA chief executive.

Revised Feature

Yet Baker thinks that a revised model could meet the needs of the consumer. To a certain extent, this venture was an experiment for Google – complete with experimental apps and programs. In reality, the elements of search with this feature were not as advanced as on popular property sites.

Bad Timing

Timing is a big deal in real estate. With Google's real estate feature, confusion cropped up about the status of the listings. Is this a current listing?

Up-to-the minute data matters in the real estate industry. It matters to the person conducting the search. Finally, the consumer's needs decided the fate of Google's real estate feature.

Friendly Realtors

Of course, do not count Google out of the real estate game. Such a powerful entity does not reach its present position by ignoring facts or not learning from failures. If Google does try again, they will have to convince the real estate industry that listing on their Maps portal will bring in more sales. Many leading realtors did not participate in this initial project. Maybe next time, Google Inc. will find what they were searching for in the real estate listings.

Real Estate Search

Just one question! Recently, Google bought the former Port Authority Building at 111 Eighth Avenue in New York City for $1.9 billion. Did they use their Maps feature to find the listing or did they search at a real estate website?

Would You Search For Real Estate Listings On Google Maps?

Image courtesy of distilled.co.uk