With its home values increasing by almost $11 billion in 2010, the Boston housing market is going in the opposite direction of the national trend. According to Zillow.com, Boston real estate is a better and brighter market. Since the city is now in a more favorable position than the rest of the country, its market will enter 2011 in great shape.

Home Values

As the housing market stabilizes, Boston should continue as a bright spot. Keep in mind that the city's current home values are an impressive lot. After all, U.S. home values are expected to lose $1.7 trillion this year. That decrease is 63% more than the $1 trillion decline in 2009. The latest figures confirm that total value lost since the 2006 market peak has been $9 trillion.

Home values had been appreciating from 2003 to 2005 (and in certain instances, during 2006). When subprime mortgages became popular, home owners believed that their houses would continue to increase in value. The rate was unsustainable, however, even with the help of government interventions such as the expired Federal Homebuyers' Tax Credit.

The market referred to as the 'Boston Metropolitan Statistical Area' was just one of two shining lights in the recent statistics. San Diego also showed an increase of $10.2 billion in home values.

Surprising Statistics

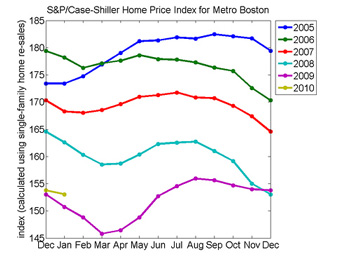

Now the Boston statistics were a bit of a surprise – at least to Robert Murphy, an economist at Boston College. He referenced the S&P/Case-Shiller Home Price Index (a measure for the U.S. residential housing market). Murphy believed that they reported home values in Greater Boston had not fallen as far as in other U.S. regions.

Yet despite his surprise at the latest statistics, this economist had to admit that Boston is enjoying a positive economy. Murphy pointed to two main industries (health care and education) stabilizing the Boston housing market as well as employment sectors. He reminds everyone, however, that Boston home values are still down $105 billion from their peak in 2005.

"The state’s unemployment rate is 8 percent, vs. 10 percent nationwide, so we’ve done better in that sense too,” says Robert Murphy, Boston economist, explaining the city's encouraging economy.

Foreclosure Effect

Is it possible that foreclosures are affecting recent statistics about Boston home values? Probably not! Yet Boston has seen its share of foreclosures.

There were 11,334 foreclosures from January-October in Massachusetts – an increase of 7,710 from 2009. Median prices for single-family homes, however, have increased since July. It will take six months (or even longer) though for downward pressure on median home prices to be felt in the market.

Falling Home Values

New York City had the biggest decline at $103 billion and Chicago experienced $48 billion in losses. The value of homes in the Chicago metropolitan area is expected to fall 7.1% (to $625.8 billion) this year compared to 2009. The predicted loss of $48 billion is a better showing than the 2009 $66.7 billion loss. A local real-estate agent believes that Chicago home values will decline another 2%-3% during 2011. That fall would be a result of increased foreclosures and short sales.

What Is The State Of Home Values In Your Area?