Holiday tidings – home mortgage rates are holding their own. Last week, there was a spike but - according to Freddie Mac – hardly any change this week on fixed-rate mortgages. Based on the weekly survey of mortgage rates, we are in a period of stabilization – a positive sign for the economy.

Home mortgage interest rates had been declining in past months because of economic uncertainty. Yet earlier this month, there was a change. Home mortgage interest rates have increased recently and last week's mortgage rates took a jump. Stabilization, however, is the reality for the week ending November 24.

Home Mortgage Rates

Rates on 30-year fixed-rate mortgages averaged 4.4% on November 24. That rate is just a slight increase over last week's rate; 4.39% was the rate for the previous week. Freddie Mac mortgage rates have increased for the past four consecutive weeks. The rate averaged 4.78% in 2009.

Fifteen-year fixed-rate mortgages averaged 3.77% this week - compared to 3.76% in the previous week and 4.20% last year. Five-year Treasury-indexed hybrid adjustable-rate mortgages averaged 3.45% this week - up from 3.4% in the preceding week. The ARM averaged 4.18% in 2009.

Obtaining Rates

To obtain the rates, the 30-year fixed-rate mortgage required payment of an average 0.8 point. The 15-year fixed-rate mortgage required an average 0.7 point and both ARMs required an average 0.6 point. A point is 1% of the mortgage amount charged by the bank as a prepaid mortgage interest.

Freddie Mac

Frank Nothaft, vice president and chief economist at Freddie Mac, released promising news on varied fronts on Wednesday. He noted an improvement in home owner balance sheets as well as a decrease in mortgage delinquency rates in the third quarter of 2010. Actually, there has been an overall decrease in delinquency rates. They have fallen to 9.13% - the lowest rate since the first quarter of 2009. Freddie Mac's chief economist also mentioned other encouraging signs for the economy."Growth in gross domestic product in the third quarter was revised up from the initial estimate to an annualized rate of 2.5%, as stronger consumer spending and exports supported the revision," says Frank Nothaft, vice president and chief economist at Freddie Mac.

Wells Fargo

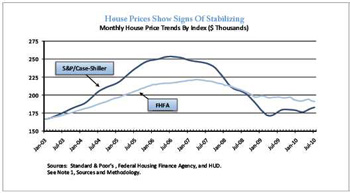

Wells Fargo also showed stabilization after a volatile couple of weeks. Mortgage rates have been moving around but the movement has been limited to only a certain level. Check out more specifics about Wells Fargo and mortgage rates. It will be easier to make more long term projections if mortgage rates remain stable so that we can determine effectively the overall scope. Industry experts believe that home values will not stabilize completely until the end of 2011 or middle of 2012.

Housing Market

Looking ahead to 2011, some industry leaders say that potential home buyers and homeowners wanting to refinance should experience favorable conditions in the coming months. Analysis seems to suggest that rates will stay below 5% - at least until mid-2011. Home buyers are expected to be lured back into the housing market with low mortgage rates, affordable house prices, and improving employment figures.

What Is Your Prediction For The Housing Market In 2011?

Image courtesy of poloclubhomesforsale.blogspot.com