Ah, home sweet home! Make that home 'small' home for an increasing number of home builders and home buyers. House construction is seeing smaller and less expensive homes because builders are not getting the same price as before for expansive, upscale properties. A few builders claim that they are not making back the construction costs.

Shrinking Size

Some builders are getting rid of homes at a loss and concentrating instead on the business of renovation. Although in uncertain economic times, neither one is a safe bet. Everything has experienced a decrease in this economy (in certain areas more than others). Everything from house appraisals to new homes to house prices is seeing a decline – and now houses are also shrinking in size.

Part of the decision to go 'smaller' is fuelled by varied events that have undermined people's confidence in the market. Such issues as foreclosure rates, flawed foreclosures, lending issues, and more, are causing a build up of anxiety among potential home buyers. Of course, home builders share their anxiety.

"It's slowing the recovery of new construction. It's sapping confidence," says Robert Filka, CEO of the Michigan Association of Home Builders

In a certain Michigan suburb, a 3,600-square-foot home with 10' ceilings, is selling at a loss for the builder at $699,000. In 2008, that same home was priced at $875,000. Within the past decade, homes in that neighborhood had sold for $2,000,000. Times have changed and builders are changing with them.

No Luxury

With unpredictable appraisals that can come in even $80,000 less than expected, luxury homes can be a problem. Appraisers have to factor in recent sales in the neighborhood. At present, neighborhood sales can include anything from a short sale to a foreclosure.

As well, home buyers are often asked for higher

down payments (even up to 25%). Luxury homes may start looking less and less appealing to home buyers. Builders who have noticed that trend are opting to construct smaller homes. Maybe a less expensive home will not seem as intimidating to the potential home buyer.

Downsizing

Some people are adamant about the benefit of small houses. Cost-effectiveness, smaller mortgages, and a simpler lifestyle are a few reasons that people give for choosing smaller and less expensive homes. Even environmental reasons play into the desire for smaller homes. They use fewer resources in building and for maintenance.

Of course, buying a 'too small' home is not a wise move. A home can be as small as anything - as long as it suits your needs. If a home does not have sufficient space, it will not work for a growing family.

Perfect Fit

Yet if the size suits you, a small home might be the right choice. People have found 'small home' ownership to be an exhilarating experience. It frees up savings for travel and it frees up the precious commodity of time.

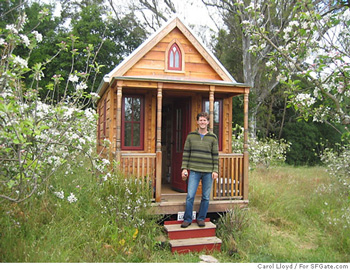

'Small home' ownership means less time spent cleaning and fewer hours required for maintenance. Smaller homes allow you to have more quality time with family and friends. Maybe though not everyone will want to go as 'small' as this home builder.

Would A Small Home Suit Your Needs?